CREDITORS | AGENCIES | LAWYERS | INSOLVENCY

Empower your customers to engage with you

How much someone can afford should not rely on guesswork

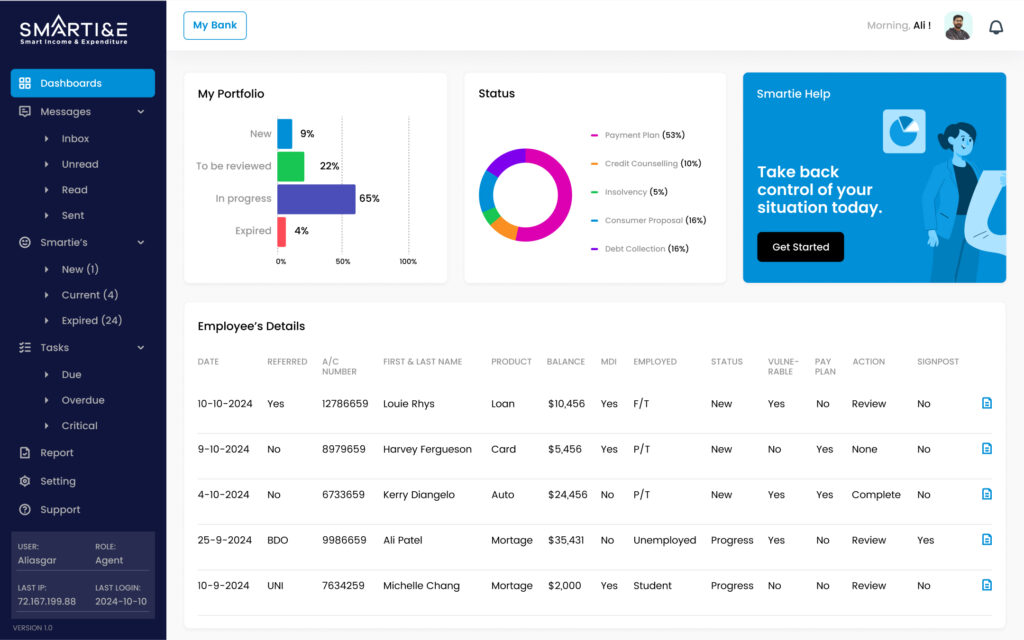

Consumer’s are more reluctant to engage and share data now and too often consumer’s end up in collections or insolvency as we cannot establish a repayment plan. We understand from experience of working with banks, telco, utilities and anyone in collections can be expensive and time consuming. You cannot rely on just credit reports alone as they don’t provide essential expenditure nor have accurate income figures. Nor do you want Payslips and bank statements shared with you as it increases your risk to handling sensitive and personal information.

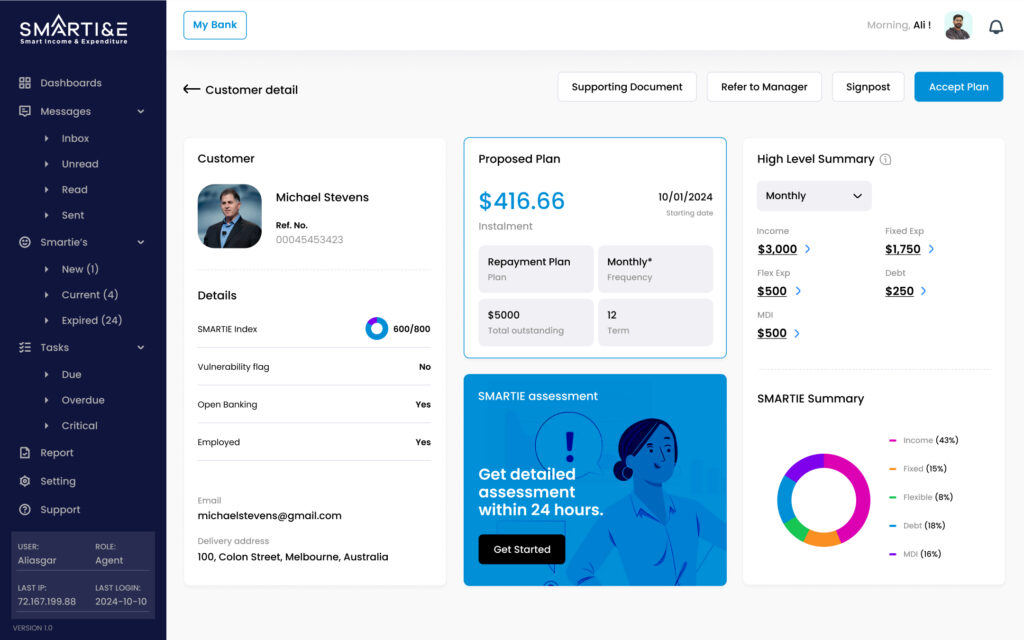

Its impossible to determine the financial health of a consumer and know how best to treat them without knowing their true affordability. As a creditor you will rarely have sight of more then just your own loan or service even with credit reports. With SmartI&E we will provide the true affordability position and every monthly transaction across multiple bank accounts so you can make an informed decision.

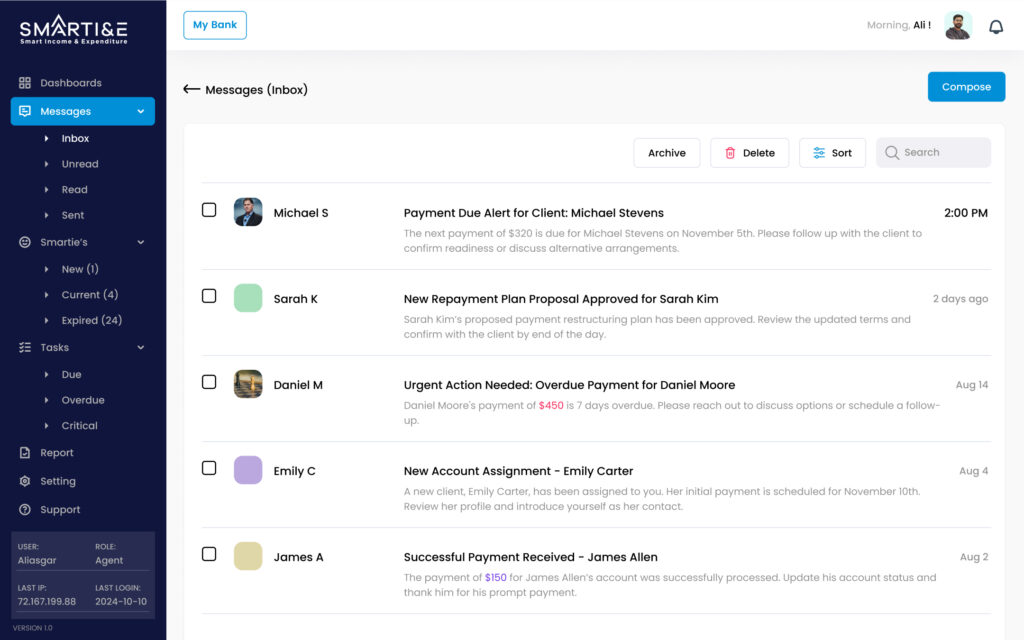

What took 45 mins to weeks to assess now takes 3 minutes and can be done digitally allowing your agents to focus their time on the resolutions not data capture or chasing customers. A secure link is sent from your desktop to a customer who can complete SmartI&E in minutes using open banking data. Once completed it appears in your desktop. No guesswork, just accurate real-time transactional information that calculates their income, expenditure and vitally their their disposable income.

You can quickly determine whether you can offer a repayment plan to rehabitate or refer the customer for professional services such as credit counselling, insolvency or a consolidation loan partner.